child tax credit 2021 portal

The IRS recently upgraded the Child Tax Credit Update Portal to enable families to update their bank account information so they can receive their monthly Child Tax Credit payment. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive.

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return.

. The Child Tax Credit Update Portal has been updated to allow families to update their direct deposit information or to unenroll from receiving advance payments for the child tax credit. Any remaining Child Tax Credit benefits will be paid when eligible parents and. Half of the money will come as six monthly payments and half as a 2021 tax credit.

The IRS will make a one-time payment of 500. 15 but doubts arise around the remaining amount that parents will receive when they file their 2021. 2021 Tax Filing Information.

To be eligible for this rebate you must meet all of the following requirements. This tool an update of last years IRS Non-filers tool is. It also made the.

IR-2021-218 November 9 2021. The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. The additional child tax credit may give you a refund even if you do not owe any tax.

IR-2021-129 June 14 2021. Here is some important information to understand about this years Child Tax Credit. The advance Child Tax Credit or CTC payments began in July 2021 and end.

You can also refer to Letter 6419. Updates that have been made by August 2 nd 2021 will apply to the August 13 th payment as well as any. The Child Tax Credit provides money to support American families.

Simple or complex always free. Child Tax Credit Payment Schedule 2022Irs started child tax credit ctc portal to get advance payments of 2021 taxes. WASHINGTON The Treasury Department and the Internal Revenue Service today unveiled an online Non-filer Sign-up tool designed to help eligible families who dont normally file tax returns register for the monthly Advance Child Tax Credit payments scheduled to begin July 15.

Irs started child tax credit ctc portal to get advance payments of 2021 taxes. That total changes to 3000 for each child ages six through 17. File a federal return to claim your child tax credit.

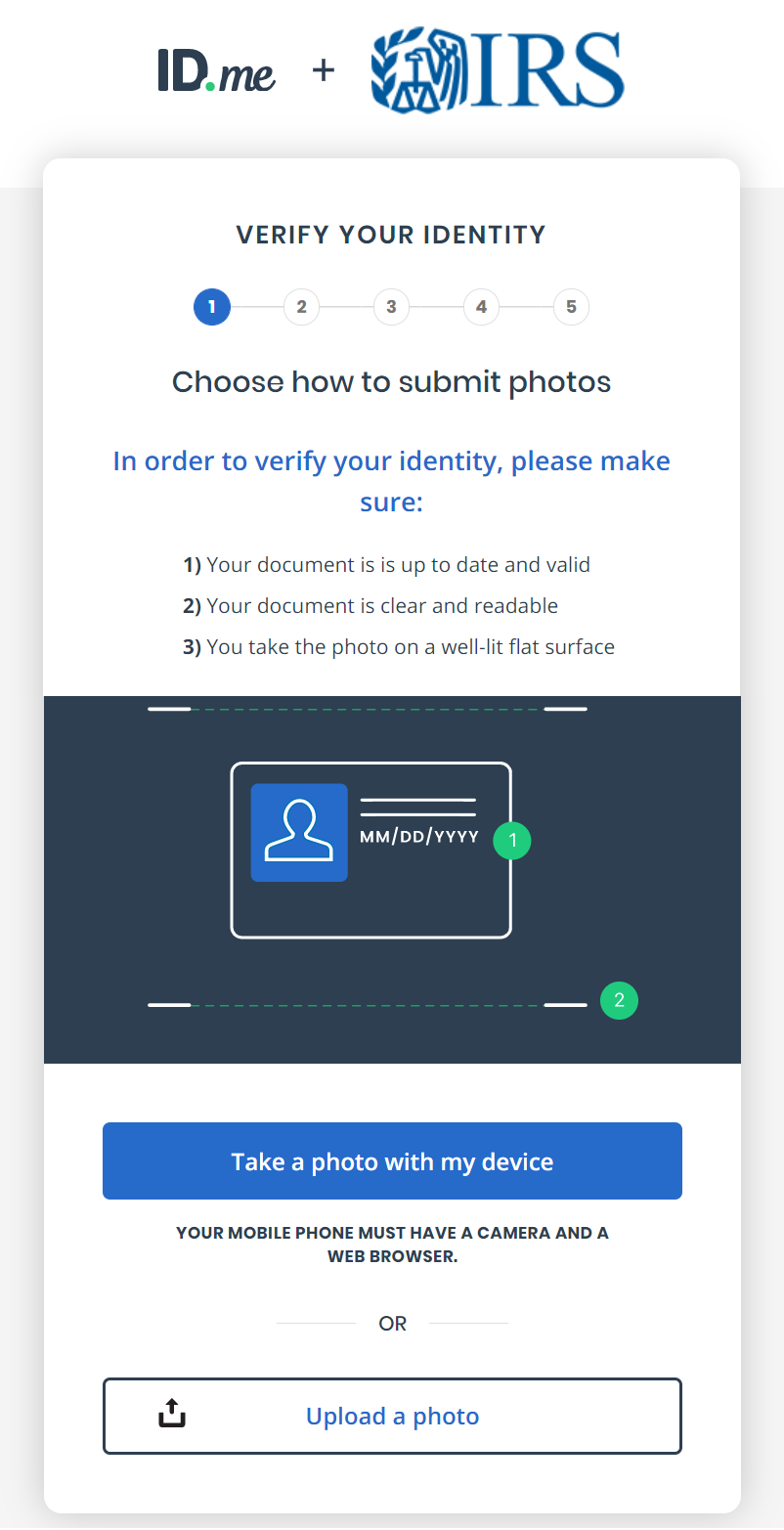

You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account. See below for more information. The Child Tax Credit Update Portal allows families to update direct deposit information or unenroll.

You must be a resident of Connecticut. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. New study highlights the cost.

The IRS used the information from your 2019 or 2020 tax return to estimate your eligibility for monthly Child Tax Credit payments in 2021 and send payments equal to half of the amount of Child Tax Credit that the IRS estimated you would be able to properly claim on your 2021 tax return. For 2021 eligible parents or guardians can receive up to 3600 for each child who was under 6 years old at the end of 2021 and up to 3000 for each child who was between the ages of 6 and 17. The enhanced child tax credit payments are only set to last through 2021 but President Biden has suggested that this may be extended through as long as 2025 as part of the American Families Plan.

WASHINGTON The Internal Revenue Service today updated frequently-asked-questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit Payments to describe how taxpayers can now provide the IRS an estimate of your 2021 income using the Child Tax Credit Update Portal CTC UP. You may be eligible for a child tax rebate of up to a maximum of 750 250 per child up to three children. Get your advance payments total and number of qualifying children in your online account.

IRS Child Tax Credit Portal and Non-filers. Sign in to your account. The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000.

You must have claimed at least one child as a dependent on your 2021 federal income tax return who was 18 years of age or younger. Taxpayers can access the Child Tax Credit Update Portal from IRSgov. COVID Tax Tip 2021-101 July 14 2021.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. In january 2022 the irs will send letter 6419 with the total amount of advance child tax credit payments taxpayers received in.

Child Tax Credit Update Portal Update Your Income Details Review Your Payments And More Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Did Your Advance Child Tax Credit Payment End Or Change Tas

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

2021 Child Tax Credit Advanced Payment Option Tas

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Training Becoming A Ctc Navigator And Non Filer Ctc Update Portals Walk Through Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back